Morning Toast 1 August

Highlights

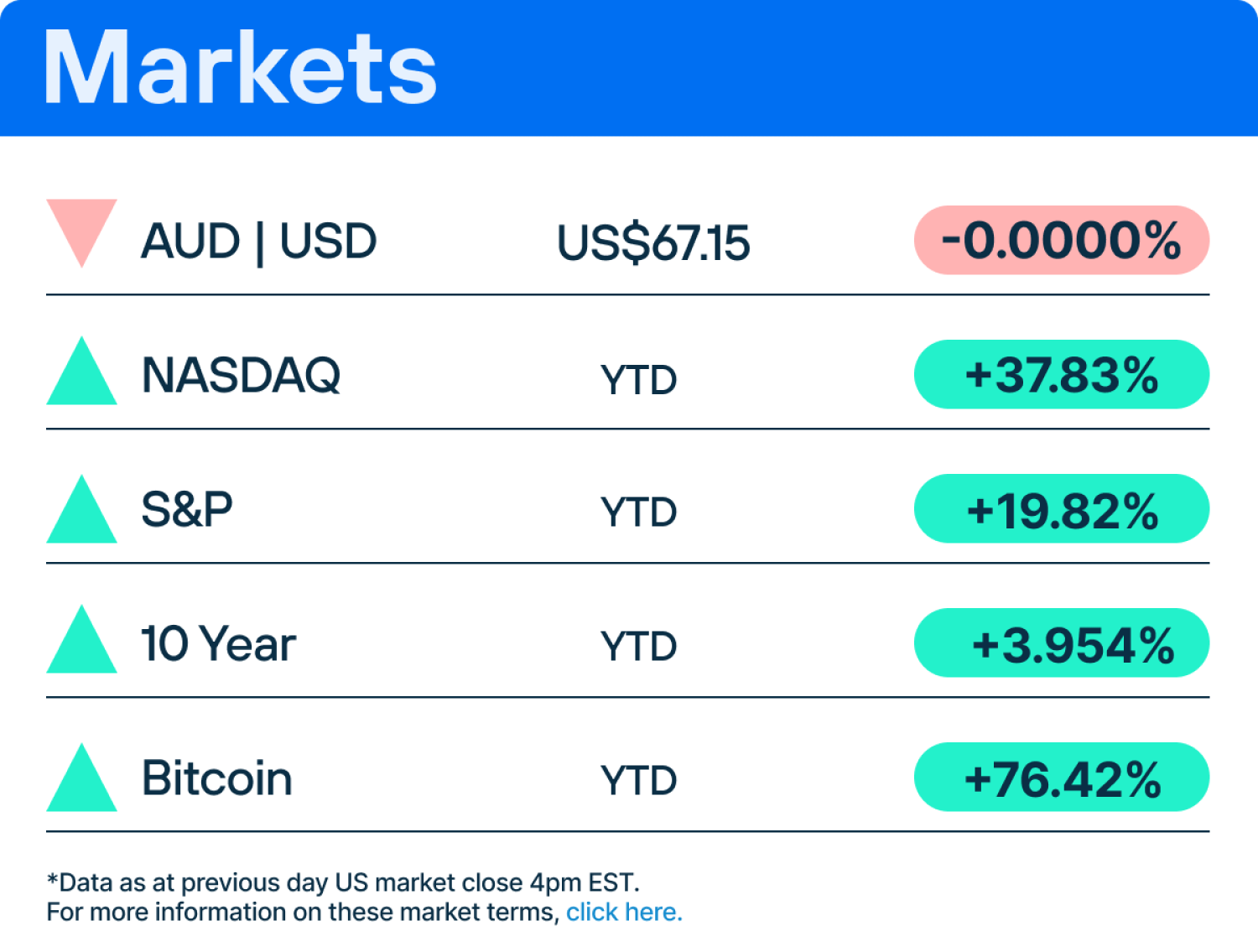

With a soft landing for the economy in sight, the S&P 500 is poised to conclude July with its fifth consecutive monthly gain (unless we've unintentionally tempted fate). However, transitioning into August and September comes with potential risks. Historical data from Bloomberg reveals that over the past three decades, these two months have been the most challenging for the index.

Stock Spotlight

Stock Spotlight

Birkenstock has always maintained a presence, experiencing multiple waves of popularity since its introduction to the US in the 1960s. The brand had a notable moment in the 1990s and 2000s when it gained popularity among mega-celebrities. Similar to other seemingly unconventional footwear choices, such as Crocs (which recently reported a record $1 billion in revenue for the second quarter and is valued at approximately $6.7 billion), Birkenstocks are now making a comeback.

In the last year, Birkenstock's revenue witnessed a significant increase of about 29%, reaching $1.3 billion. These sandals are no longer limited to fans of the Grateful Dead; they are now being embraced by celebrities like Kendall Jenner, and their appearance in scenes of the new Barbie movie has contributed to recent sales growth, as reported by Bloomberg.

Two years ago, L. Catterton, a private equity firm backed by the luxury conglomerate LVMH, acquired Birkenstock in a deal that valued the company at around $4.9 billion. Since then, Birkenstock has collaborated with high-end designers like Dior and Manolo Blahnik.

While the exact timing and size of the IPO have yet to be determined, sources indicate that the potential plans signify a resurgence of market debuts, as reported by Bloomberg.

Stock Spotlight

Stock Spotlight

By the end of Friday's trading session, the share price for the parent company of Google reached $132.58, marking its highest closing price in over a year.

Throughout the year, Google has faced concerns about the health of its core search business due to a decline in the digital ad market and the potential impact of AI chatbots on web traffic. However, the second-quarter earnings report, unveiled on Tuesday, demonstrated the company's resilience and versatility in overcoming these obstacles. Notably, revenue increased by 7%, rising to $74.6 billion from $69.7 billion in the same period of the previous year.

Sustainable News

This ambitious initiative is a crucial step towards reducing the company's reliance on fossil fuels and adopting more sustainable packaging alternatives.

By implementing this change, the company is expected to eliminate approximately 100 million pounds of virgin plastic usage, which is equivalent to the weight of nearly five Eiffel Towers. This demonstrates the significant impact of their efforts in moving towards more eco-friendly practices.

This latest goal builds upon the Company's existing investments aimed at reducing plastic consumption across its product range and accomplishing broader packaging targets. Among these goals are plans to ensure that all packaging becomes 100 percent recyclable, reusable, or compostable by 2025. Additionally, The Kraft Heinz Company is actively working towards achieving net-zero greenhouse gas emissions by 2050, with an interim target of halving emissions by 2030. This comprehensive approach exemplifies the Company's commitment to sustainability and environmental responsibility in its operations.

Quote of the Day

"EU Taxonomy will undoubtedly uncover the true nature of each business, driving ESG-conscious capital to where it actually belongs." — Jose Manuel Entrecanales Domeq, Chairman and CEO, ACCIONA

Stay informed with the Morning Toast

Save time with curated and delivered financial news and insights.